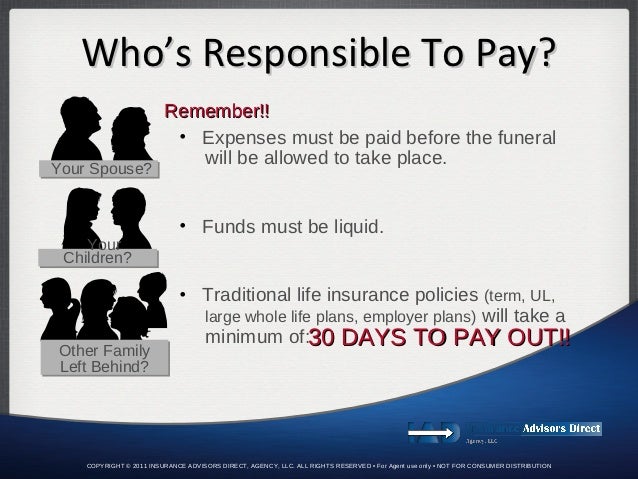

Features of Final Expense Insuranceīelow are some features of Final Expense insurance that makes it unique (varies depending on the insurer) : These policies are state regulated and designed to pay the benefit to the beneficiaries much faster than traditional life insurance policies.

FINAL EXPENSE INSURANCE FREE

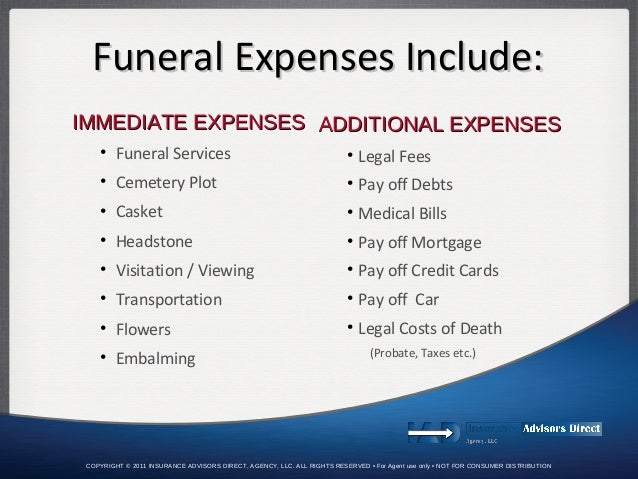

With a little planning, it is possible to provide your family with funds to help cover end of life expenses, leaving them free to concentrate on caring for each other and honoring your life.įinal Expense insurance will help cover your expenses after you have passed, including your funeral costs, medical bills, even your credit card debts. etc.Final Expense insurance can be a good way to protect your assets and provide funds for loved ones in their time of grief. Kept with your will (you have a will, right?), this document would cover issues like burial vs. If you want to leave a clear indication of your wishes without necessarily locking in the funeral home, you could always combine burial insurance with a document stating your preferences. If you go with final expense insurance instead of pre-payment, you have less control, but your family has more flexibility. Will you or your family be able to get a refund if your funeral plans change? Will you lose the money you pre-paid if you move to a different area? What happens if the funeral parlor goes out of business? With final expense insurance, your surviving relatives will receive a payout they can spend anywhere. The disadvantage of pre-payment is that it’s less flexible than burial insurance. Another advantage of pre-paying is that it will most likely prompt you to talk your choices over with loved ones, leaving them more confident that they know your wishes.

You can pick out the perfect casket and the choicest plot in the cemetery. You can grill different funeral directors until you find one you love. When you pre-pay for your funeral, you get to personalize it to your taste. This approach has advantages and disadvantages.

And it’s probably best not to count on the lump sum death payment from Social Security to pick up the slack. To self-insure is just to use your own money rather than use a life insurance payout.Ĭould your family self-insure for your final expenses? It’s a good idea to figure around $10,000 for the funeral expenses, but will you also want a catered party after the memorial service? A trip to a faraway land to scatter your ashes? Will you leave big bills behind? If you answered “yes” to any of those questions, consider springing for final expense insurance. If you have term life insurance and you outlive the policy term, you may want to consider final expense insurance at that point.Īlternatively, if your family will have plenty of assets to work with when you die, you could use what’s called “self-insurance.” “Self-insurance” is one of those terms that sounds more complicated than it is. If you already have term or whole life insurance, your loved ones can use your existing policy to pay final expenses.

0 kommentar(er)

0 kommentar(er)